You’re spending less than you earn? Good! This may seem like a no-brainer, but you’d be surprised. You’re ahead of a lot of people already. Now, let’s optimize and grow.

How much of your income are you saving? Shoot for 50% or more, but at the very least try and dedicate 25% to your investment account. Set up automatic transfers to your broker and put it to work asap (More details on this later in the guide). Continue doing this until the return on your investments outweigh your expenses. It really is that simple.

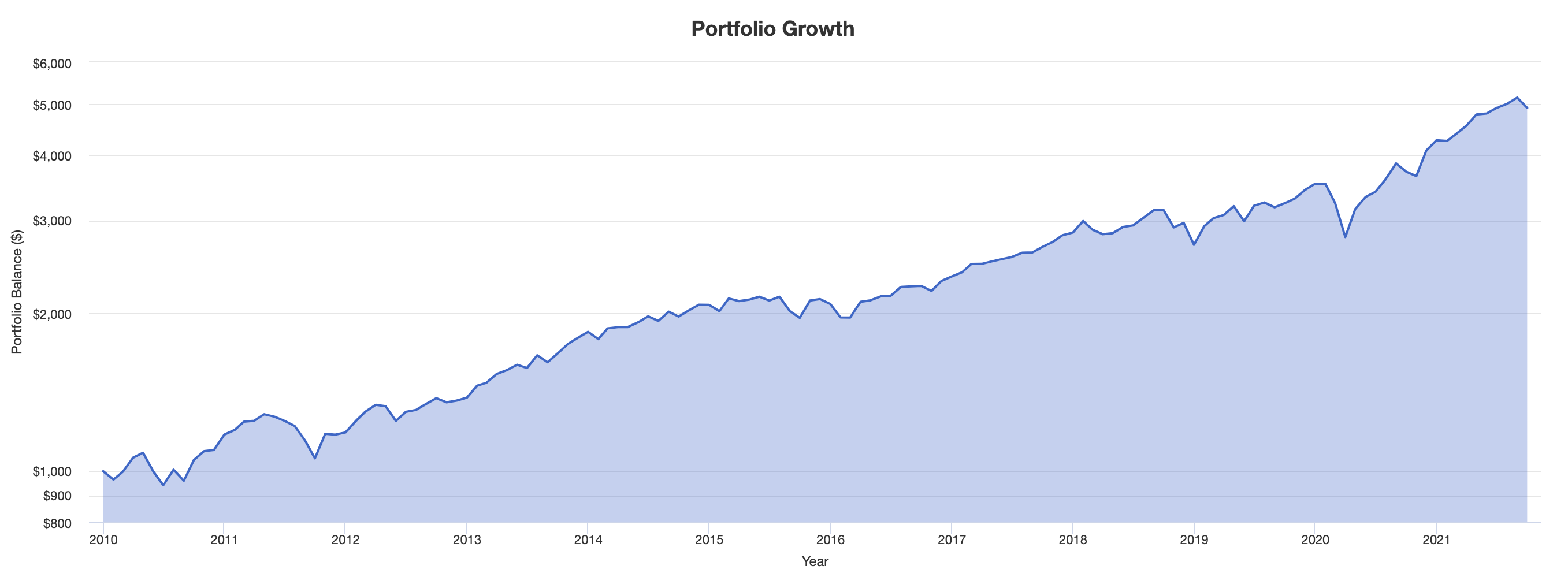

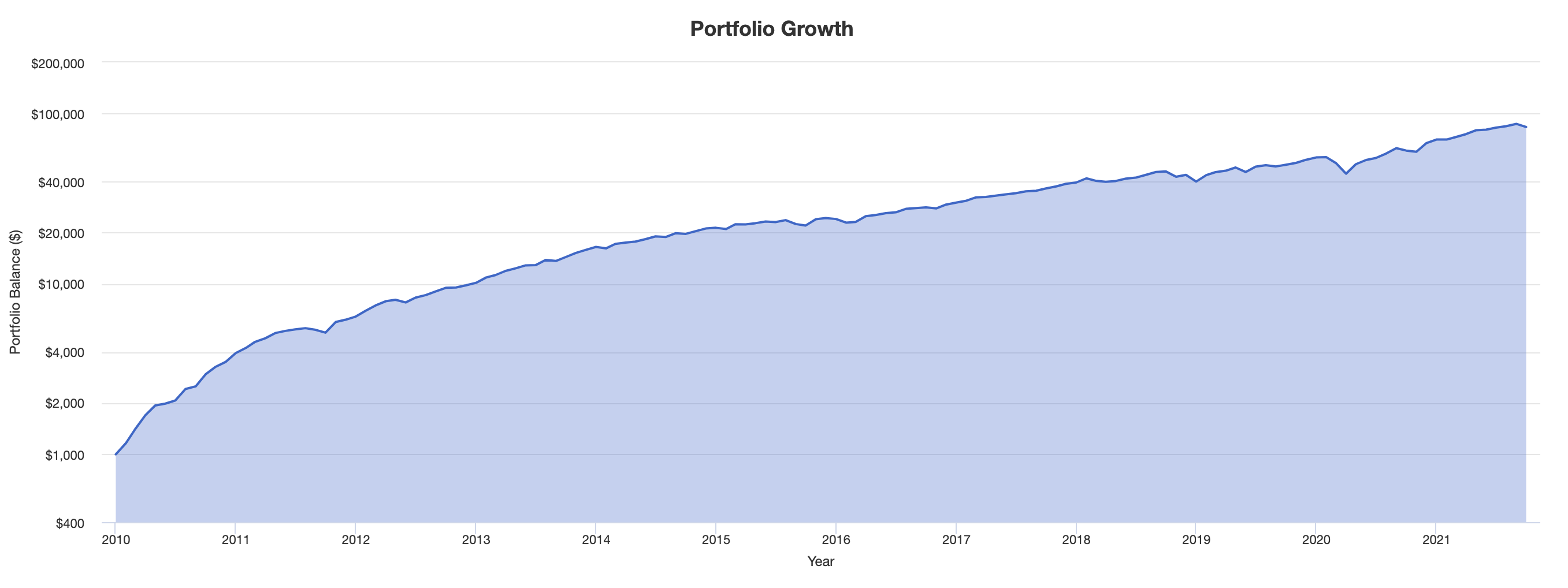

Below is an illustration of what this could look like with a starting balance of just $1,000. The following graphs display the 10-year performance of a $1k portfolio that is invested in a popular total stock market fund. This is where you want your money if you’re looking to invest in “the stock market”. The fund we used in this example is Vanguard’s VTI exchange-traded fund (ETF), but you could use any low-cost broad-market or S&P 500 fund.

What you’re about to witness below is the power of continuous contributions. This one simple strategy will propel your wealth quicker than simply being invested in the markets, and the best part is it can be 100% automated.

The first graph illustrates the trajectory of your account if no other contributions were made over the entire 10 year period. You simply invest the $1k and let it grow. You can see that investing in “the stock market” over the last 10 years was extremely profitable, having multiplied from $1k to $5k without any intervention on your part.

This next graph shows you what it would look like had you saved and invested only $100 per month over the same 10 year period. This strategy took that same $1,000 and turned it into nearly $50,000. Also take note of how bumpy the first chart is compared to the second. Continuously adding a fixed amount every month will help smooth out the ride, and make those market dips a little more tolerable (and a lot less stressful!)

Finally, If you contributed an extra $100 per month on top of that ($200 total), your account would be worth just under $100k. This is the power of saving, investing, and compounding, and this is why we recommend investing as much as possible, as often as possible. The more you contribute, the faster your account will grow. Now that we have an understanding of the basic techniques behind growing an account, let’s take the next step in determining what it will take for you to reach financial freedom.