Growing Your Account

Up until now, we’ve talked about what financial freedom is, how much money you need to get there, and how to systematically reach that goal by spending less than you earn and investing the difference. Now, on to the fun stuff. How can we use what we’ve learned so far to accumulate and keep our wealth? We’ve covered pretty much everything you need in theory, so now let’s get into the details and discuss a few tools to help pull it all together.

Remember, this is only a guide to getting started. What we’ll be outlining below is something you can set up in a matter of minutes so you can start building your account while furthering your research. In all honesty, you don’t even need to get more complicated than this, although we know a lot of people will want to tinker. If you don’t care about financial stuff the way we do, simply follow the steps below and do it forever. Years from now you’ll wake up rich, all while outperforming the vast majority of active investors and fund managers along the way.

Save, Invest, Contribute

The very first consideration we need to make is where we want to keep our money. We need somewhere that will allow us to invest in the stock market and continuously contribute more funds over time. Ideally, this process would be automated so we can simply set it up once and forget about it. Financial institutions that allow individuals like you and me to invest are called brokerage firms, or brokers, and there are many.

With so many brokers out there, how can we possibly know we’re choosing the right one? It’s actually pretty simple. Let’s think about what we want to accomplish. We want to save as much as possible as often as possible, easily invest in the entire stock market, and repeat forever. Sounds easy enough. You would think that most of the popular brokerage firms like ETrade and TD Ameritrade would support this endeavor. Unfortunately, in this case, you would be mistaken. These big brokerage firms aren’t in business to help you reach your financial goals (although their marketing teams would argue otherwise). They exist to profit from you. Lucky for us, there are several Fintech companies whose mission is to actually help us attain financial freedom. These companies support the key features and technologies we’ll need to keep this process as simple as possible. They will help us save and invest, regardless of our financial status, all while keeping fees to a minimum. Let’s break down the process of saving, investing, and contributing.

In the interest of keeping things as simple as possible, we’re going to recommend one broker for US residents and one broker for international residents. We have personally used, and continue to use both.

Although there are others in the market, M1 Finance is our recommended tool. They make it easy to sign up, create a portfolio, and continuously contribute. We’ll walk through the mechanics below.

First things first, at the time of this writing, only US Citizens and Permanent Residents (Green Card holders) over the age of 18 with a current US residential address and US phone number can apply to open an M1 Account. If you’ve met those qualifications, go ahead an open a free individual account. By the way, if you click the big green button below, you’ll earn $50 when you open and fund your account. It’s our gift to you for making it this far into the guide.

Now, it’s been a while since we’ve opened our M1 Finance account, and the onboarding process may have changed. Rather than outlining the steps here with the risk of potentially outdated information, we’re going to provide a general overview of what you’ll want to accomplish, along with links to their documentation. The process is pretty straightforward, but if you do need some help, go ahead and take a look at their docs. You can always link up with us and we’re happy to help guide you through the process as well!

Here’s a general list of things to do once you’ve opened your account. Don’t worry, once you do this once you’ll never have to do it again. It is a true set-and-forget strategy.

This should be pretty easy, but again, refer to their docs or reach out to us if you need some help.

The terminology is a bit confusing, but a portfolio is made up of one or more pies (sub portfolios), which in turn are made up of slices (stocks and/or ETFs). More info on their terminology can be found here. They have some pre-built portfolios/pies that you can choose from, but in our case, we want to create one custom pie that is made up of one slice. We’ve already done all of this in our accounts, so feel free to copy our portfolio if you don’t want to go through the entire process yourself.

There should be an option somewhere to create a custom pie. Click or tap on that, enter a name or description, then find the option to add a slice. This is where you select the stocks you want to invest in. Here, we recommend investing in a total-market ETF. This is a single fund that will get you invested in the entire US stock market. We are personally invested in Schwab’s Broad Market ETF ($SCHB), but Vanguard’s $VTI is an identical alternative.

This can be any amount. It doesn’t matter how much. Whatever you’re comfortable with. The goal here is to deposit as much as possible, as often as possible. If you’ve got a lump some you’d like to start with, you can select the one-time transfer option. If not, go ahead and select the amount of money you’d like to deposit on an ongoing basis, and choose recurring transfer. You can always change it later, and remember, you can always work with us directly to build a plan and work through a few potential scenarios when it comes to starting balances and continuous contributions.

This will automatically invest your newly added funds to your portfolio. This should be enabled by default, but if it’s not, go to your portfolio page and toggle the Auto-invest option on. With this feature, all dividends and bank transfers will be automatically invested. This is true passive investing!

Unfortunately, the options for international brokers are limited. This is especially true when examining the features required to facilitate a true passive investment strategy like the one we outline below. We are working hard to fix this!

That being said, we’ve been using Interactive Brokers for years to invest in the US markets. Although there are other international brokers, IB offers the widest range of investment options, provides the best security, and still keeps investment fees to a minimum.

Even though international residents don’t have the same access to cutting edge Fintech brokers like in the US, the process is the same. It’s just a bit more manual. Still mostly passive, but not 100%.

First things first, go check out the Interactive Brokers Available Countries page to see if your country is supported. Once you’ve confirmed that your country is supported, find the button that says “Open Account” and click on it. You’ll need to fill out an application, submit it, then wait for someone on their side to review and approve.

Now, it’s been a while since we’ve opened our IB account, and the onboarding process may have changed. Rather than outlining the steps here with the risk of potentially outdated information, we’re going to provide a general overview of what you’ll want to accomplish, along with links to their documentation. The process is pretty straightforward, but if you do need some help, go ahead and take a look at their docs. You can always link up with us and we’re happy to help guide you through the process as well!

Here’s a general list of things to do once you’ve opened your account.

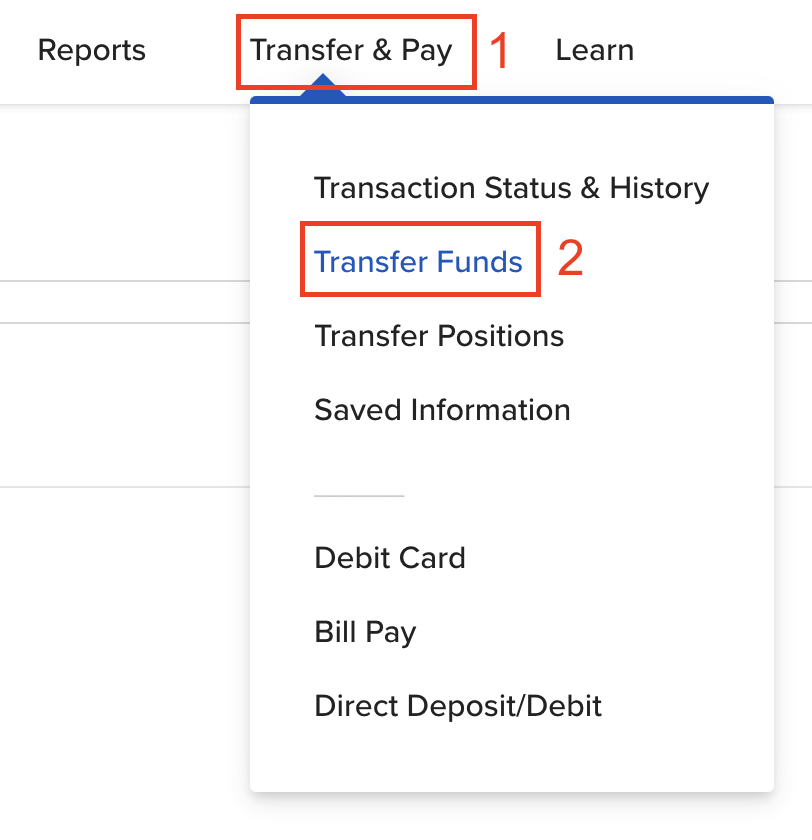

Once you log in, you should see a button at the top of the page for “Transfer & Pay”. Click on that and choose “Transfer Funds”. Select “Make a Deposit” and choose your desired transfer method on the next screen. While going through the process, be on the lookout for a checkbox that says something like “Make this a recurring transaction?”. We highly recommend selecting this to enable automatic transfers from your bank into your brokerage account on a regular basis. This will automatically take funds from your bank and put them into your brokerage account on a recurring basis, so be sure to enter an amount you’re comfortable with. If you’ve made it this far into the guide, you should already have a budget in place and a solid idea of how much you can/want to invest. We always recommend investing as much as possible as often as possible. Refer to their docs (just click on the heading above) to get more info about the funding process or reach out to us if you need some help.

Invest

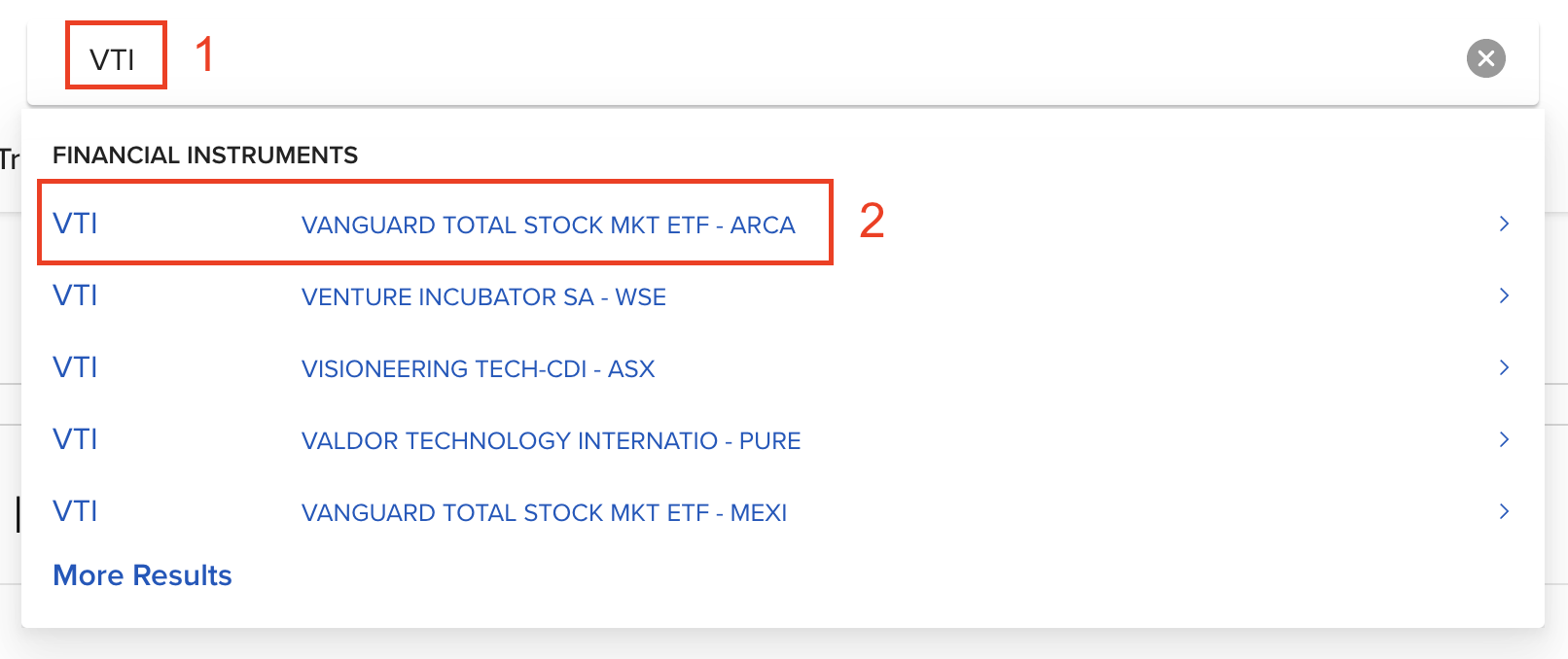

This is where you select the stocks or ETFs you want to invest in. Here, we recommend investing in a total-market ETF. This is a single fund that will get you invested in the entire US stock market. We are personally invested in Schwab’s Broad Market ETF ($SCHB), but Vanguard’s $VTI is an identical alternative. Let’s walk through the process together. It’s pretty easy once you get the hang of it.

Once you log in to the IB portal, you should see a search field at the top of the page. Click in there and type SCHB or VTI to search for either of those ETFs. Be sure to choose the one from the list that says “ARCA”, then select “Stock”

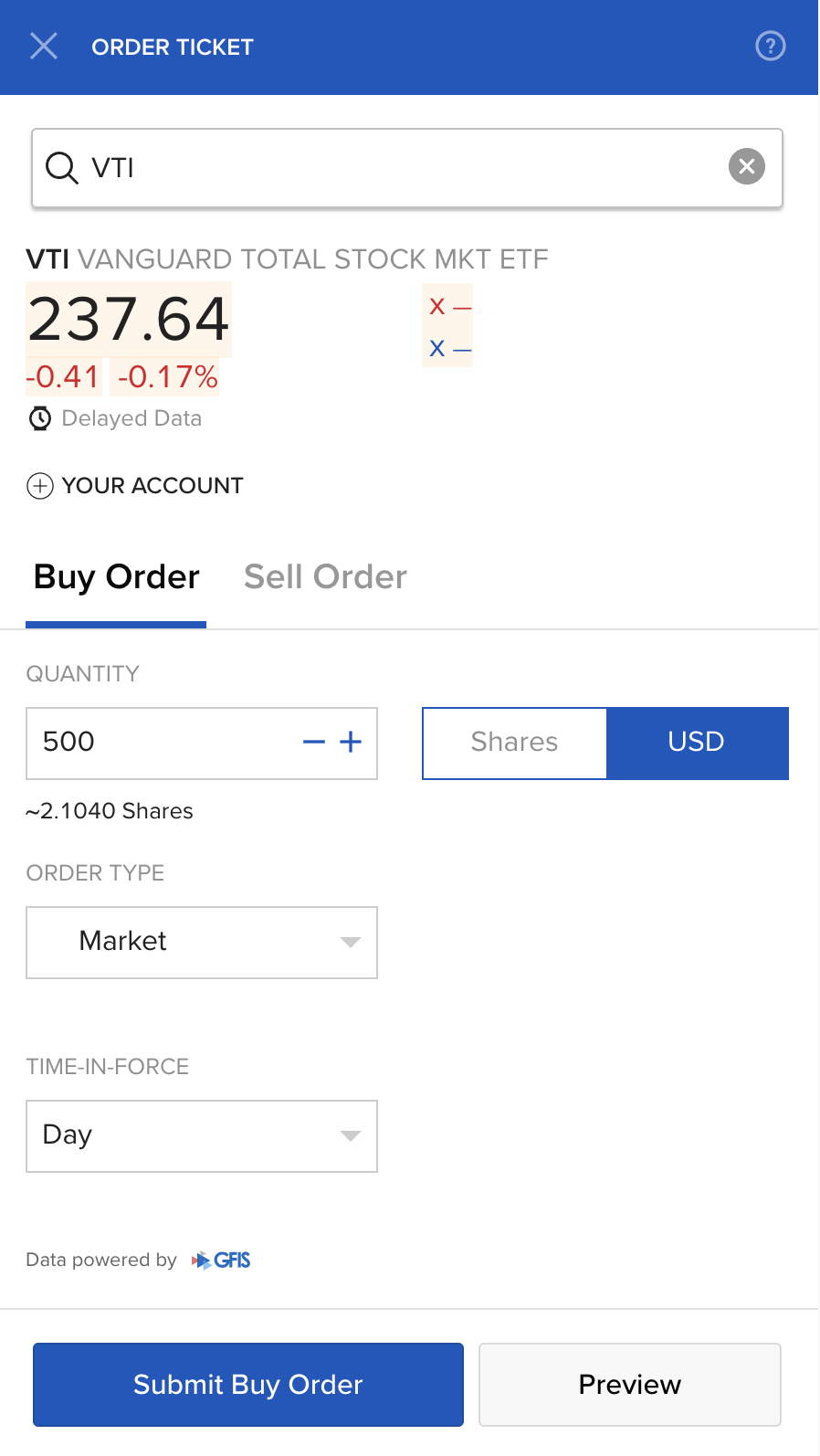

This will take you to the fund profile page where you can see all kinds of data like the price chart and latest news. Find the big blue button that says “Buy” and click on it. This will bring up a window to start a new order. Make sure “Buy Order” is selected, then choose USD. Enter the dollar amount that you would like to invest, then select “Market” from the “Order Type” dropdown menu.

That’s it, you’re ready to submit your order. After clicking “Submit Buy Order”, you may see a few pop ups. These are generally ok to accept, but if you have any questions be sure to reach out to us and we’ll guide you through the process. Once you set up automatic deposits, you’ll want to go through this process every time your new funds land in your account. Continuously investing (buying more shares) will increase your dividend payouts, smooth out the ride (the stock market can be volatile!), and help to propel the growth of your account.