The VTI ETF is a total market fund that tracks the performance of the CRSP U.S. Total Market Index. VTI measures the entire investable U.S. equity market, making it a well-diversified fund that holds over 3,600 stocks.

With a 0.03% expense ratio, VTI is an extremely low-cost way to get exposure to the U.S. equity market. This is one of the most popular long-term investment securities and is highly recommended for anyone looking to steadily grow their account over an extended timeframe. VTI is a true one-stop-shop for any passive investor.

| VTI Annual Performance | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| 17.26% | 1.06% | 16.41% | 33.51% | 12.56% | 0.40% | 12.68% | 21.16% | -5.13% | 30.80% |

VTI is an excellent choice for investors or traders looking for inexpensive, comprehensive, total-market equity exposure. The fund offers neutral coverage, making no industry or size bets to speak of. Moreover, VTI can be traded easily in any size, and true holding costs are typically even lower than its microscopic fee. In short, it’s incredibly cheap to access and to own. This makes it a sound choice for long-term investors.

etf.com

| ETF | Expense Ratio | 10yr Performance |

| VTI | 0.03% | 11.56% |

| ITOT | 0.03% | 12.02% |

| IWV | 0.20% | 11.10% |

Related Posts

May 5, 2023

Beginner Stock Trading Tactics for Post-Earnings Momentum

Earnings season is an exciting time for stock traders, as it can lead to…

March 30, 2023

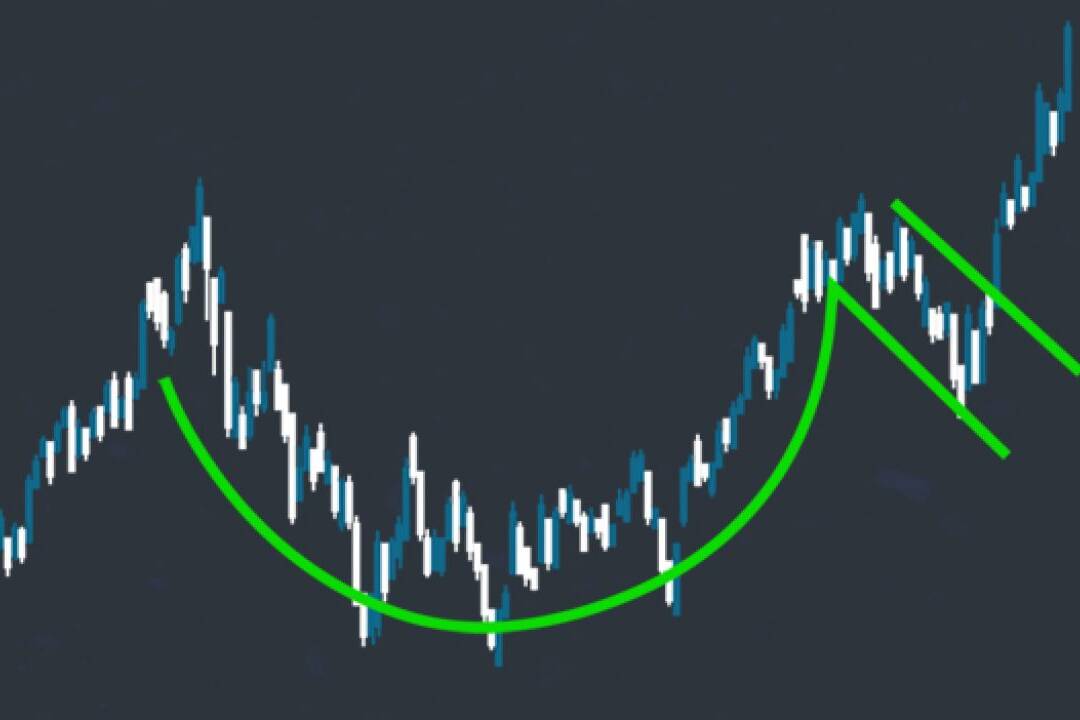

Buying Earnings Winners in Structural Bases: The Cup-with-Handle Approach

Successful stock trading often involves identifying patterns that signal…

March 23, 2023

Demystifying Earnings Events: A Beginner’s Guide for Entry-Level Traders

Earnings events are significant market occurrences that can greatly impact a…