Earnings season is an exciting time for stock traders, as it can lead to significant price swings and potentially lucrative trading opportunities. In this blog post, we will explore a few beginner-level stock trading tactics to take advantage of post-earnings momentum. These tactics will focus on basic technical analysis and strong risk management principles to help you make informed trading decisions.

Tactic #1: Look for Breakouts with High Volume

One of the most straightforward ways to leverage post-earnings momentum is to look for breakouts on high volume. A breakout occurs when a stock’s price moves above a previous resistance level, usually accompanied by high trading volume. High volume indicates that many market participants are involved in the trade (including institutions), which increases the likelihood of a sustained move in the stock’s price.

To use this tactic, set up your stock scanner to filter stocks that have recently released earnings and are experiencing a breakout on high volume. This will help you identify potential post-earnings momentum plays.

Tactic #2: Moving Averages

Moving averages can help you identify the stock’s overall trend, which is essential when trading post-earnings momentum. A moving average smoothens out price data, making it easier to spot trends.

To use this tactic, apply a 50-day and a 200-day simple moving average (SMA) to the stocks identified by your scanner. If the stock’s price is above both the 50-day and 200-day SMAs, it indicates a strong uptrend. Consider entering a long position in such stocks, but always use a stop-loss order to manage risk.

Tactic #3: Use Support and Resistance Levels

Support and resistance levels are critical for risk management in stock trading. Support levels are prices where buyers have consistently stepped in, preventing the stock from falling further. Resistance levels, on the other hand, are prices where sellers have consistently pushed the stock down, preventing it from rising further.

To use this tactic, identify key support and resistance levels in the stocks filtered by your scanner. When entering a trade, place your stop-loss order slightly below the identified support level (for long positions) or slightly above the resistance level (for short positions). This will help limit potential losses if the trade goes against you.

Tactic #4: Set Profit Targets and Stick to Them

One of the biggest challenges for beginner traders is knowing when to exit a profitable trade. Setting profit targets can help you lock in profits and avoid giving back gains.

To use this tactic, establish a profit target based on a risk-reward ratio that you are comfortable with, such as 2:1 or 3:1. This means that for every $1 of risk, you expect to make $2 or $3 in profit. Once the stock reaches your profit target, sell your position and take the profit, even if the stock appears to have more upside potential.

Related Posts

March 30, 2023

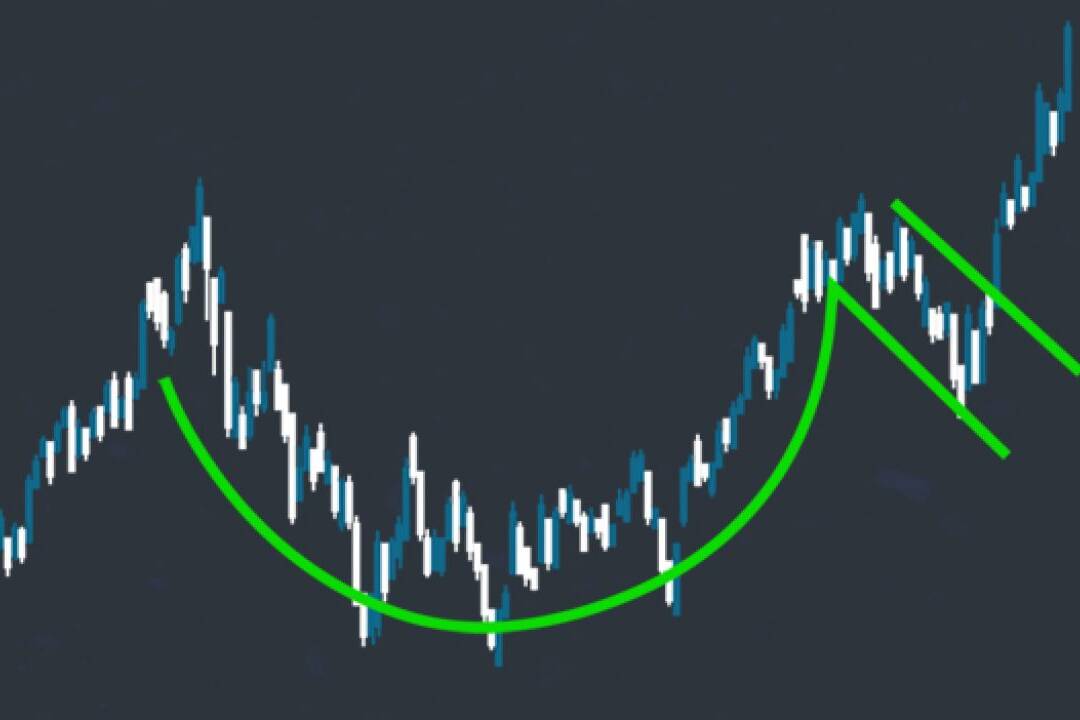

Buying Earnings Winners in Structural Bases: The Cup-with-Handle Approach

Successful stock trading often involves identifying patterns that signal…

March 23, 2023

Demystifying Earnings Events: A Beginner’s Guide for Entry-Level Traders

Earnings events are significant market occurrences that can greatly impact a…

January 30, 2022

Weekly Trade Review Jan 28, 2022

Reviewing recent earnings winner trades $LLNW, $HAL, $RTX, $PCAR, $ZION, $HPQ