IWM is what you would get if you ranked all public companies by market capitalization and just removed the 1,000 largest ones. It’s an ETF that tracks the performance of the Russell 2000 index, which is made up of the 2,000 smallest stocks on the U.S. market.

Similar to SPY for large caps, IWM is the most tracked and traded out of all the small-cap ETFs.

Many investors prefer watching small-cap funds to more mainstream market indexes like the S&P 500 or Dow because they think they are a better representation of the economy and overall stock market. This is because small-cap companies are more sensitive to the ebbs and flows of the economy, and tend to be more domestically focused.

During recessions, many of these companies may go bankrupt. This is in contrast to mid-cap and large-cap companies that have more established operations and reserves to get through and thrive during tough times.

For these reasons, small caps are considered a leading indicator for the economy. When traders become eager about the possibility of economic growth, they move into small caps. When they are worried about a slowdown, they start to sell small caps first.

| IWM Annual Performance | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| 26.76% | -4.19% | 16.39% | 38.85% | 4.94% | -4.33% | 21.36% | 14.66% | -11.02% | 25.42% |

the Russell 2000 index is rebuilt from scratch each year to make sure that it only ever tracks the results of the smallest stocks in the market. That way, if companies experience strong growth and move into large-cap status, they don’t distort the performance and characteristics of the true small-cap opportunity set.

This behavior also results in higher turnover than what you typically see in larger index-based funds. The Russell 2000 ETF churns through 20% of its stocks every year, which corresponds to a completely new set of companies roughly every five years. Compare this to SPY, which has a turnover of less than 5%. Because of this maintenance, IWM will likely have a higher expense ratio.

| ETF | Expense Ratio | 10yr Performance |

| VTWO | 0.10% | 1.32% |

| SPSM | 0.05% | 0.05% |

| IWM | 0.19% | 7.42% |

Related Posts

May 5, 2023

Beginner Stock Trading Tactics for Post-Earnings Momentum

Earnings season is an exciting time for stock traders, as it can lead to…

March 30, 2023

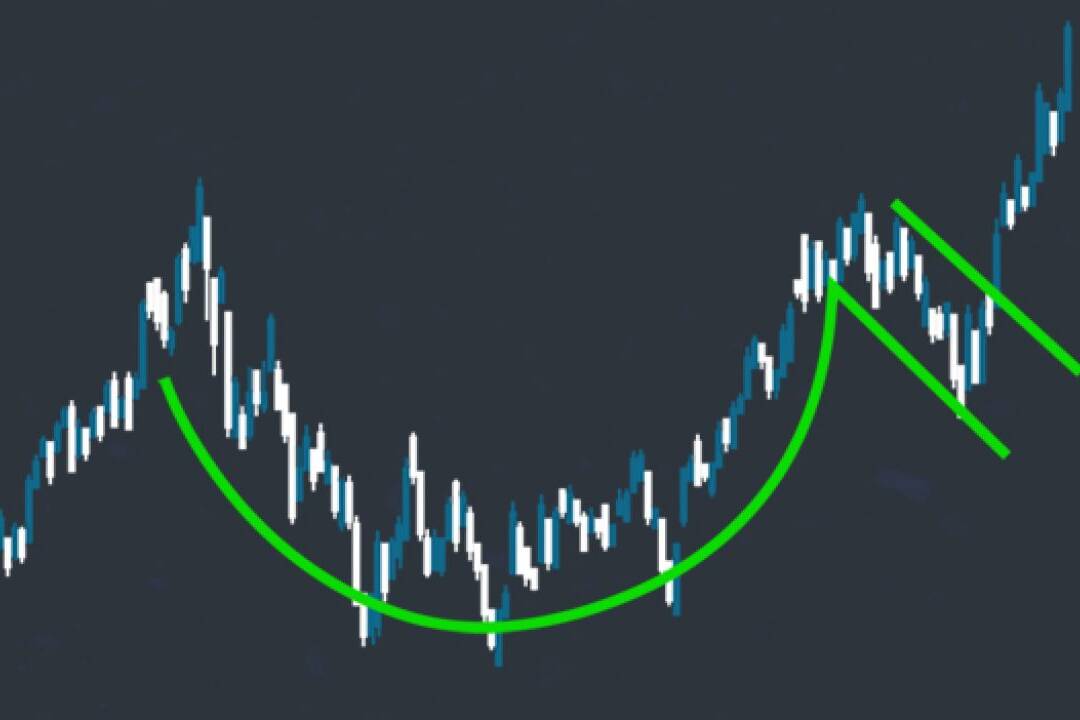

Buying Earnings Winners in Structural Bases: The Cup-with-Handle Approach

Successful stock trading often involves identifying patterns that signal…

March 23, 2023

Demystifying Earnings Events: A Beginner’s Guide for Entry-Level Traders

Earnings events are significant market occurrences that can greatly impact a…