US Banks and financials kicked off Q2 earnings last week. Results were generally bleak, with many banks setting aside a lot of cash in anticipation of future loan losses. Meaning, the economy will probably get a lot worse, before it gets better. The relative winners were those with large institutional trading floors, that saw a huge spike in fixed-income revenue (JP Morgan, Goldman Sachs, Morgan Stanley). Looking at the results across a few industry leaders – Bank of America Merrill Lynch (BAC), Charles Schwab (SCHW), JP Morgan (JPM), and Wells Fargo (WFC) – a few themes emerged:

- Huge reserve builds (anticipating higher loan losses):

- Banks put a lot of cash aside, in anticipation of future loan losses due to a weaker economy. JPM & WFC forecast the unemployment rate to stay around 10% through the end of the year.

- JPM – increased reserves by 36% or $8.9 bn QoQ. concentrated in card & wholesale

- BAC – reserve build of $4bn; up 100% from 2019

- WFC – reserve build of $8.4bn QoQ

- Institutional (bond) trading saves the day for banks:

- Though the reserve builds took a toll on earnings, many of the banks did okay-ish due to stellar trading revenues from the investment bank, with revenues up anywhere from 35-170% YoY.

- JPM – fixed income trading up 99% YoY & 47% QoQ

- BAC – sales & trading revenue up 35% YoY, though down slightly QoQ

- Despite increased retail trading volumes, trading revenues were down:

- Trading volumes at Schwab were up 126% YoY (1.62 million daily active trades), but revenue per trade decreased to $1.89 vs. $1.97 QoQ, resulting in trading revenue falling 7% YoY

- Cash is king

- Deposits grew & asset managers saw inflows into money markets as clients flocked to the safest asset – cash

- BAC – Global banking deposits have grown 31% YTD

- WFC – AUM up $578bn or 17% YoY – higher market valuation & money market flows, equity outflows

- JPM – Total deposits are up 25% YoY & 16% QoQ and in Asset management, there were $95bn flows into money markets

- Net Interest Income** (NII) generally down (big source of revenue):

- Declined due to the full impact of lower rates

- WFC – NII down 18% YoY

- SCHW – Net Interest Revenue down 14% YoY

- BAC – NII down 11% YoY

- JPM – NII down 4% YoY

- Wealth Management – clients seeking expertise:

- SCHW – Investment professionals remain in demand, with Schwab Intelligent Portfolios Premium planning appointments increasing 30% from a year earlier

- BAC – 2Q20 net new households of $6,000 in Merrill Lynch & 500 in Private Bank

- Digital & online solutions:

- BAC highlights digital solutions in their quarterly earnings. They highlighted the % of consumer sales online increased to 47% vs. 29% last year. Advisors are also reacting, with 98k WebEx meetings hosted by FAs – up 419%.

- SCHW – Client utilization of digital advisory solutions remained strong, with balances up 12% YoY

- Schwab continued to get new clients:

- New assets of $137b partly due to the USAA acquisition. Excluding the USAA acquisition assets grew $47bn, with an increase of 552,000 new accounts. Retail accounted for 80% of asset growth vs. 20% RIA/ advisor

- Wells Fargo’s outlook is grim:

- Many of the banks did okay-ish, due to an increase in trading volumes. Wells Fargo doesn’t have a big trading division, so their business felt the full brunt of lower rates & a need to increase loan provisions. They cut their dividend by 80% and warned of job cuts ahead (5-10%)

- It’s going to get worse – quotes from management:

- “the most tumultuous period since the Great Depression” — Bank of America’s CEO Brian Moynihan

- “May and June will prove to be the easy bumps in terms of this recovery. And now we’re really hitting the moment of truth, I think, in the months ahead.” — Jennifer Piepszak, JPMorgan’s C.F.O.

- “Our view of the length and severity of the economic downturn has deteriorated considerably from the assumptions used last quarter.” —Charlie Scharf, Wells Fargo’s C.E.O.

- “I don’t think anybody should leave any bank earnings call this quarter simply feeling like the worst is absolutely behind us and it’s a rosy path ahead.” — Mike Corbat, Citigroup’s C.E.O.

Read more

Related Posts

March 30, 2023

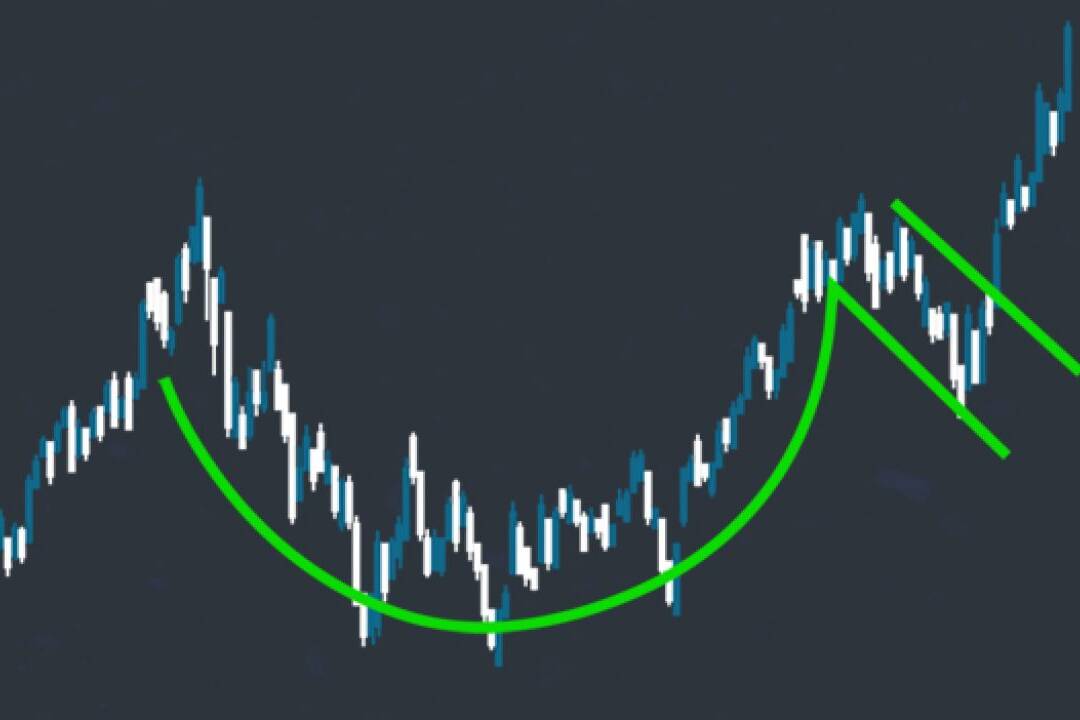

Buying Earnings Winners in Structural Bases: The Cup-with-Handle Approach

Successful stock trading often involves identifying patterns that signal…

March 23, 2023

Demystifying Earnings Events: A Beginner’s Guide for Entry-Level Traders

Earnings events are significant market occurrences that can greatly impact a…