Pros

- You can sell ETFs with little difficulty making it easy to retrieve money from the sale.

- ETFs are volatile, so there is ample opportunity for attractive returns on your investment.

- ETFs are easy to trade because you can buy or sell during regular market hours just like stocks.

- One ETF can provide exposure to a group of equities, industries, or countries, making them a great tool for diversification.

- ETFs are passively managed, which makes them an extremely low-cost investment vehicle.

- A very popular passive income stream is stock dividends. ETFs that are made up of stocks pay those dividends to the investor (you).

- It is very easy to see what stocks make up an ETF, what percentage of the fund is invested in each stock, and what expenses are associated with investing in the fund. Other types of funds don’t offer this type of transparency.

Cons

- Because ETFs are so easy to buy and sell, this could introduce brokerage fees that cut into your returns.

- There are about 5,000 ETFs in the global marketplace. This doesn’t bode well if you are the indecisive type.

- ETF performance is tied to an index. If the index goes down, so do your returns.

- You get the good and the bad. Your ETF could have holdings in very strong stocks, but it could also carry some poor performers as well. When you buy an ETF you are invested in all of the stocks that make up that fund–you can’t take one out if you don’t like it.

Related Posts

March 30, 2023

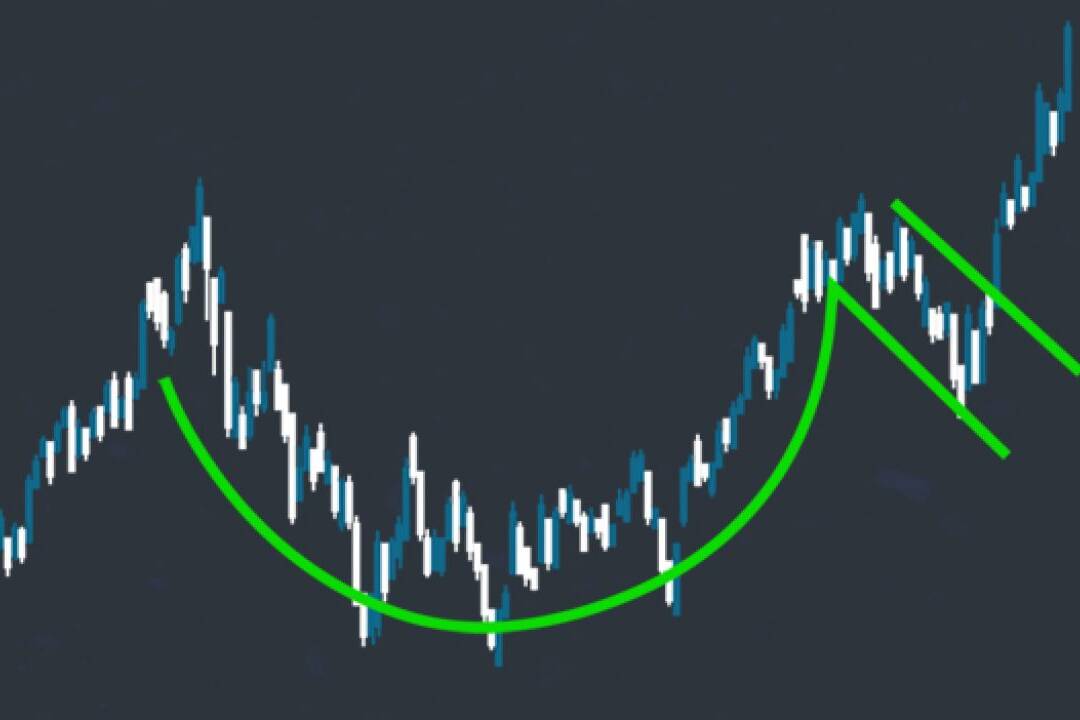

Buying Earnings Winners in Structural Bases: The Cup-with-Handle Approach

Successful stock trading often involves identifying patterns that signal…

March 23, 2023

Demystifying Earnings Events: A Beginner’s Guide for Entry-Level Traders

Earnings events are significant market occurrences that can greatly impact a…