Markets Today

Pessimism ran high to close out the week as a rash of bad news and tougher rules on banks mandated by the Fed soured sentiment. All sectors of the S&P 500 closed lower today, and the DJIA is at its lowest levels in a month. June looks like it will end up with the DJIA and the S&P 500 in negative territory after a blistering May.

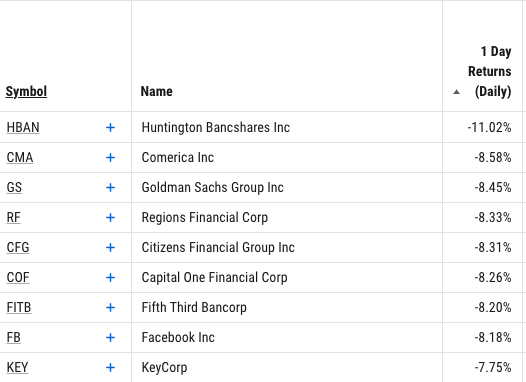

Bank stocks led the market lower today as investors are not liking the Fed’s mandate that they hold more capital and not increase their dividends this year. A dislocated economy, high unemployment, ultra-low interest rates, and more capital reserve requirements are all a recipe for bad bank profits.

More states halted their reopening plans, as Florida closed all bars and Texas ramped up social distancing guidelines, again. The U.S. should take a long look at what European countries have done to slow the spread of the virus, as there is a lot to be learned from their example.

chart courtesy Deutsche Bank

Headlines:

- Consumer spending, which represents more than two-thirds of economic demand in the U.S., remained far below pre-pandemic levels, down 12% from February. Personal consumption, the amount Americans spent on goods and services, rose 8.2% in May from a month earlier, the Commerce Department said Friday. That was more than double the prior all-time high since record-keeping began in 1959.

- Amazon is buying self-driving car startup Zoox for over $1 billion, according to reports from The Information and the Financial Times. This could either be to aid its delivery ambitions or to compete with the likes of Waymo in the space. Founded in 2014, Zoox has raised close to $1 billion in funding, according to Crunchbase.

- Gap (GPS) shares soared Friday after Kanye West shared a photo that touted his collaboration with the retailer. Gap said West is developing a clothing line for men, women, and kids that will be sold in its stores and online. The retailer said in a news release that the items from his fashion brand, Yeezy, will be made up of “modern, elevated basics” sold at “accessible price points.”

- Nike reported a surprise loss for the fiscal Q4 quarter. Revenue plunged 38% year-over-year to $6.3 billion. Net loss was 51 cents per share. Digital sales increased 75% and made up 30% of total revenue. The company will be cutting jobs as it refocuses on selling directly to consumers.

- Unilever will halt U.S. ads on Facebook and Twitter for the rest of the year, citing hate speech and polarized politics as the key reasons for its decision. Other brands, including outdoor gear company Patagonia, Verizon Communications Inc., and Ben & Jerry’s—a Unilever subsidiary—have also pledged to boycott ads on Facebook and Instagram. Shares of FB fell 8.5%.

- The 32nd annual FTSE Russell U.S. Indexes rebalancing will take place after markets close today. $9 trillion in assets are benchmarked against the indexes, which hold up to 4,000 stocks, and this year trading volume is expected to spike even more than it usually does. Healthcare stocks are expected to be the biggest group seeing promotions and additions.

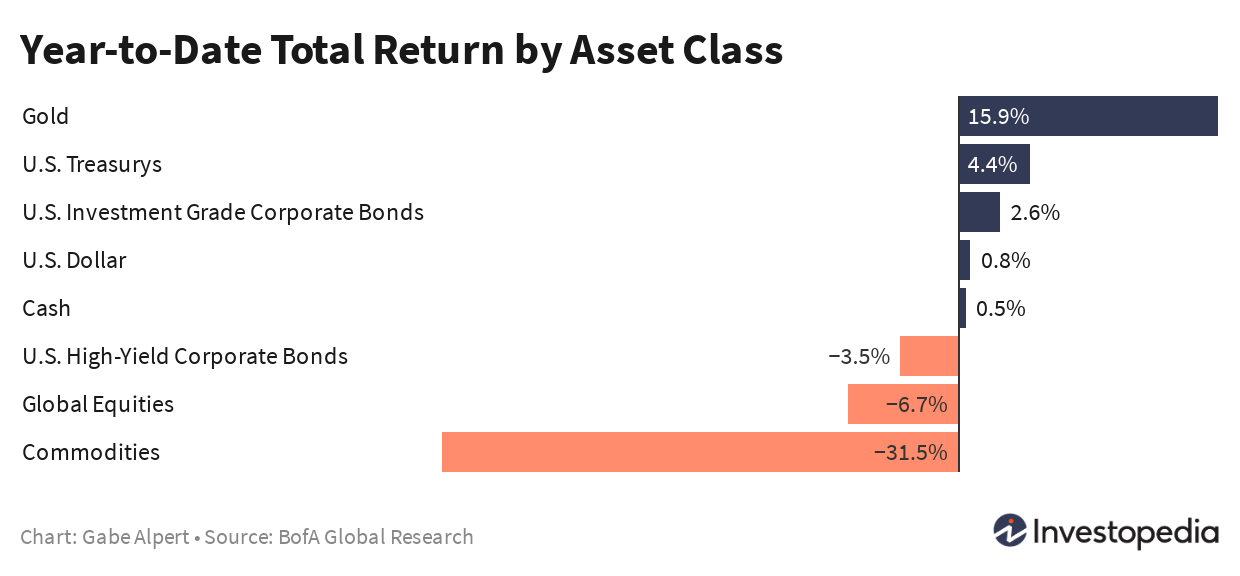

2020 By The Numbers

2020 has been a most unusual year for investors. If I told you in January that gold, tech stocks, and government bonds would deliver the best returns for the first half of 2020, you probably would’ve unsubscribed.

But those returns don’t even begin to tell the story of what has unfolded so far.

Here are a few more:

- COVID-19 deaths: 485,000

- Market value lost in fastest bear market in history: $20 trillion

- Global GDP losses (est.): $10 trillion

- Global policy stimulus: $18 trillion

- Global interest rate cuts: 149

- Cash raised by corporate bond issuance: $2.5 trillion

- Money flows into cash: $1 trillion

- Market cap gains since the March 20 bottom: $22 trillion

The second half of the year will be anything but smooth. Sentiment has been bearish for weeks, and the challenges in the way of a robust economic recovery seem to compound daily.

chart courtesy MorganStanley

Four Big Risks to the U.S. Recovery

The resurgence of the virus and the recent spikes in cases across cities that have reopened is far and away the biggest risk to our health and our economies. As per the chart above (apologies for the blur), open states have seen the most virus spikes in the past month. Underneath that risk are a series of other clear and present challenges facing the U.S. economy. Here are some of the main ones:

- Unemployment insurance: The incremental $600/week is set to expire on July 31. At the current level of nearly 20 million people receiving unemployment insurance, this would equate to a reduction in personal income of $48 billion, or $576 annualized, or 2.7% of GDP.

- Stimulus checks are no longer rolling in: The majority of the stimulus checks were distributed in mid/late April. To date, around $270 billion of the $290 billion has been pumped in.

- 77% of the $670 billion in Payroll Protection Program loans have been approved. Businesses have until the end of the year to use it, but it was originally designed to help businesses through a two-month shock.

- State and local aid: The CARES Act allocated $150 billion to state and local governments to be used for unexpected coronavirus-related costs. But the funds did not address the revenue shock state and local governments have experienced. According to the National Conference of State Legislatures (NCSL), 29 states, and the District of Columbia, expect their general fund revenues to be lower than their pre-COVID projections. Without aid, these governments will be forced to make further cuts to employment and services, in addition to making more layoffs.

What to Expect This Week

Manufacturing reports from major economies for the month of June will indicate how strong the recovery has been this past month. The June U.S. unemployment report on Thursday will show us whether May’s surprise was a fluke or a trend.

Here are just some of the major economic events to focus on in the week ahead:

Monday, June 29:

- Brazilian Unemployment Rate (May)

- U.S. Pending Home Sales (May)

- Chinese Manufacturing Purchasing Managers’ Index (PMI) (June)

Tuesday, June 30:

- U.K. Gross Domestic Product (GDP) (Q1)

- Eurozone Preliminary Consumer Price Index (CPI) (June)

- Canadian GDP (April)

- U.S. Chicago PMI (June)

- U.S. Conference Board Consumer Confidence (June)

- Chinese Caixin Manufacturing PMI (June)

Wednesday, July 1:

- Market Holiday in Canada for Canada Day

- U.K Nationwide Housing Price Index (HPI) (June)

- German Manufacturing PMI (June)

- German Unemployment (June)

- French Manufacturing PMI (June)

- Italian Manufacturing PMI (June)

- Eurozone Manufacturing PMI (June)

- U.K. Manufacturing PMI (June)

- U.S. ADP Nonfarm Employment (June)

- U.S. ISM Manufacturing PMI (June)

- U.S. Federal Open Market Committee Meeting Minutes Are Released

Thursday, July 2:

- Eurozone Unemployment Rate (June)

- U.S. Nonfarm Payrolls (June)

- U.S. Weekly Initial Jobless Claims

- Japanese Services PMI (June)

- Chinese Caixin Services and Composite PMI (June)

Friday, July 3:

- U.S. Market Holiday for Independence Day

- Eurozone Services and Composite PMI (June)

- U.K. Services and Composite PMI (June)

(chart courtesy YCHARTS)

Kanye West came through for The Gap, agreeing to a 10-year licensing deal to produce a low cost clothing line for the mass market. Networking and telecom equipment stocks were among the rare winners today.

Banks of all sizes were sold hard today, from Goldman Sachs to Huntington Bancshares. The Fed’s mandate to hold capital reserves at high levels and the prohibition of dividend increases led to pessimism against the sector.

Word of the Day

Weak longs

Weak longs are investors who hold a long position and are quick to exit that position at the first sign of weakness. This type of investor is typically trying to capture upside potential in a given security but is not willing to take much loss. These investors will quickly close their positions when a trade does not move in their favor.

image courtesy loc.gov

Related Posts

March 30, 2023

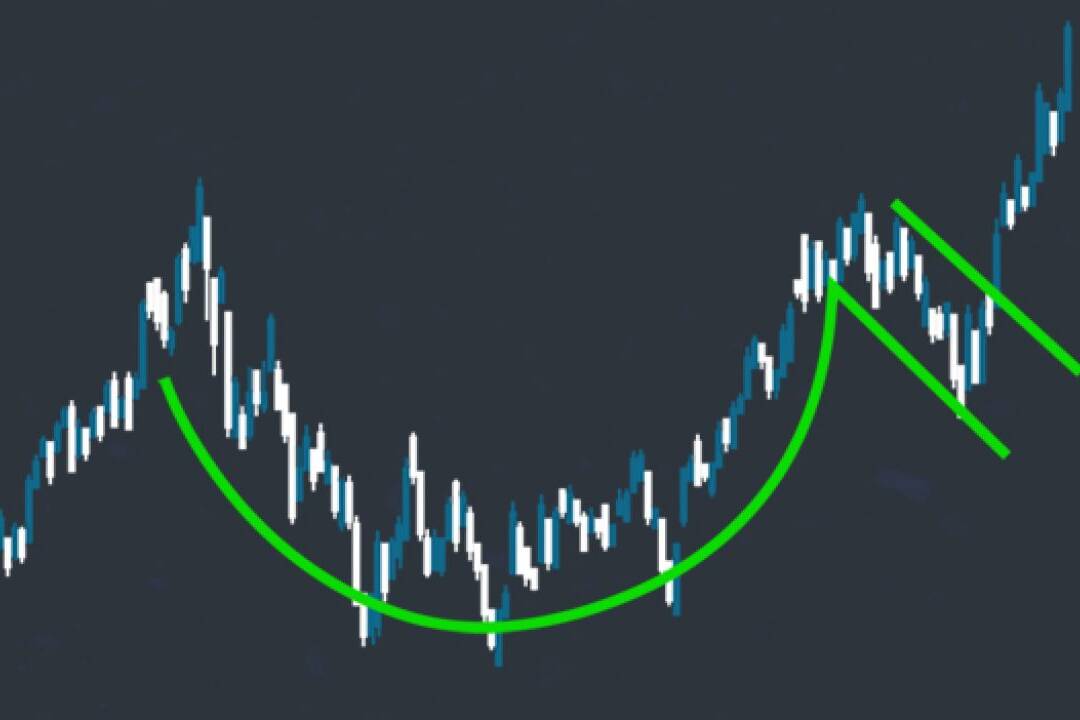

Buying Earnings Winners in Structural Bases: The Cup-with-Handle Approach

Successful stock trading often involves identifying patterns that signal…

March 23, 2023

Demystifying Earnings Events: A Beginner’s Guide for Entry-Level Traders

Earnings events are significant market occurrences that can greatly impact a…

Like!! I blog quite often and I genuinely thank you for your information. The article has truly peaked my interest.

Great article. I am going through many of these issues as well..

I want to say that this post is amazing, nice written and come with approximately all vital infos.

Great article! We are linking to this great post on our website. Keep up the great writing.

I regard something genuinely interesting about your weblog so I saved to bookmarks.

Im grateful for the blog. Much thanks again. Want more.

You should take part in a contest for one of the most useful websites online.

I like this post, enjoyed this one thank you for putting it up.

Hurrah! At last I got a web site from where I can in fact get helpful data regarding my study and knowledge.

Some really nice and useful information on this web site, besides I think the layout has got great features.

Fine way of explaining, and good article to obtain information on the topic of my presentation subject, which i am going to convey in college.

I’m really impressed with your writing skills and also

with the layout on your blog. Is this a paid theme or did you customize it yourself?

Either way keep up the nice quality writing, it is rare

to see a nice blog like this one these days.