This was originally posted at https://www.interactivebrokers.com/en/general/communiques/2021/2021-Q3-vol15.php#section-pfof-drop

What is payment for order flow?

Many brokers sell their clients’ orders to market makers who pay the brokers for these orders. The market makers trade with the orders by taking the other side of the trade and thus, establishing an execution price.

Are there any restrictions on the price at which a market maker can fill an order?

Yes. The SEC requires that all orders be executed at or inside the NBBO (the national best bid / offer). The best bid is the highest bid displayed among all the exchanges and the best offer is the lowest offer displayed among all the exchanges in the U.S. There is an exception to this rule when the size of an order exceeds the size displayed at the NBBO.

Are there downsides of brokers selling their orders to market makers?

Brokers say that if they sent the order to an exchange, that order would trade at the NBBO, but when they send the order to a market maker, the order also trades at or slightly better than the NBBO. Since the broker gets paid for the order it can afford to charge zero commissions. In this sense the customer is not disadvantaged.

Since most retail brokers sell their orders to market makers, nearly 50% of orders are executed away from the exchanges. As a result, liquidity at the exchanges has diminished and it is likely that the NBBO is now wider than it would be if all orders went to the exchanges. So although market makers do give a slight improvement over the NBBO, if they did not divert orders from the exchanges it is likely the NBBO would be narrower.

Lastly, many institutional traders do not want to show their orders at the exchanges for fear of driving the price away from themselves. Instead, they prefer to route these orders into Dark Pools. When brokers who do not sell their orders (but want to execute them at the best possible price), send the orders into Dark Pools, they often get an execution well inside, often even in the middle of, the NBBO. Seeking such executions is standard practice for IBKR Pro orders.

What is a Dark Pool?

Many brokers maintain Dark Pools in which institutional traders can rest hidden orders. These hidden orders are not shown to anyone, but when a retail order comes in on the opposite side of the market, it can execute against a hidden order so long as the execution price would be at or inside the NBBO. By trading with each other directly, both the institutional trader and the retail customer benefit.

Related Posts

May 5, 2023

Beginner Stock Trading Tactics for Post-Earnings Momentum

Earnings season is an exciting time for stock traders, as it can lead to…

March 30, 2023

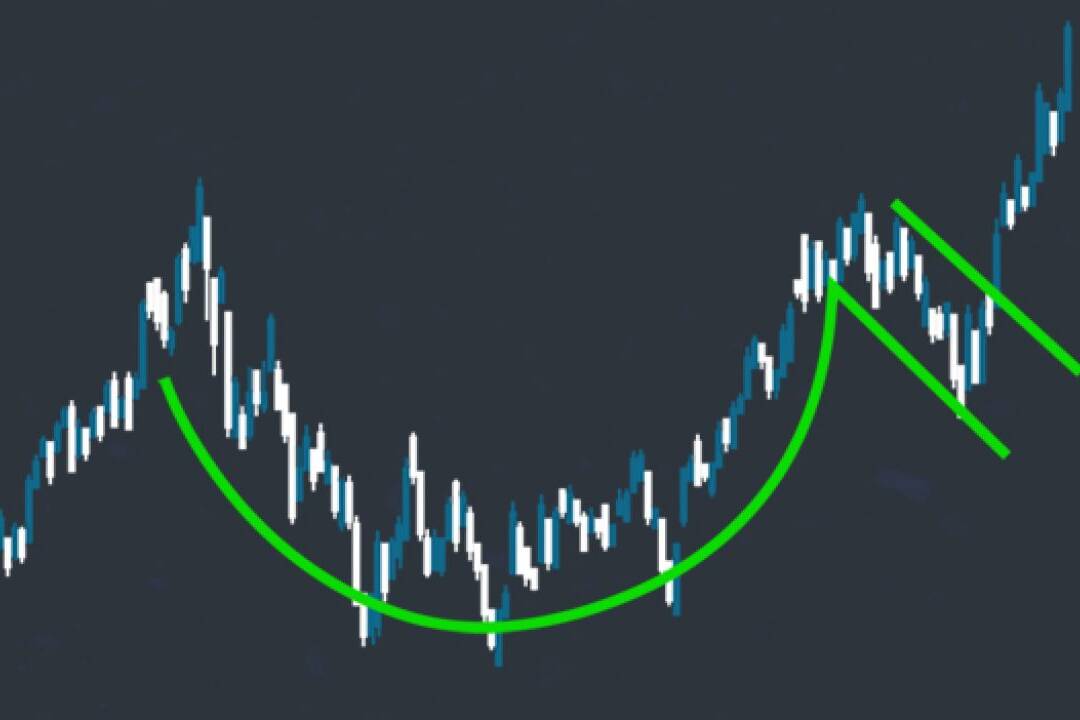

Buying Earnings Winners in Structural Bases: The Cup-with-Handle Approach

Successful stock trading often involves identifying patterns that signal…

March 23, 2023

Demystifying Earnings Events: A Beginner’s Guide for Entry-Level Traders

Earnings events are significant market occurrences that can greatly impact a…