On Monday, Dubai TV has hosted Hasnae Taleb, a young entrepreneur and investor, to speak about her experience in trading, earnings winners strategy, and collaboration with Chris Wood, an American expert stock trader and coach.

During her interview, she was asked a couple of questions about the most successful strategies that worked for the EarningsWinner.io young team, the challenges the stock market is currently facing, and what makes a successful trader. From her interview, we would highlight the 7 top questions asked.

How does a person start entering the world of investing and trading without falling into the trap of fraud?

“The logical first step for anyone looking to learn a new skill is to find a mentor or teacher”, she said. Learning from other’s mistakes can be an easy way to accelerate your learning curve, and imitating the successful traits of those who have walked this path before can act as a shortcut to success. The rise of social influencers over the last decade has resulted in a surplus of fake gurus in the trading and investment industry. You’ll know a FURU when you see one. They will be posting pictures of big piles of money or fancy sports cars. Very few will post actual trades or practical tips. Look for a mentor who has a verified track record and produces content that is both helpful and genuine. Be sure to do your own due diligence before paying any service for education or money management. There is a lot of good information available for free on the internet, and part of what we are doing with our service is consolidating this information to make it easier to get started off on the right path.

What causes stocks to rise and fall?

“The most obvious reason that a stock goes up or down has to do with how much money the corporation makes”, she says. “If a company is making money or might make money in the future, more people will buy shares of its stock”, she adds. The name of the game is supply and demand. Because of supply and demand, when there are more buyers than sellers, the stock price will go up. If there are more sellers than buyers, the stock price will go down.

Often stocks go up or down based primarily on people’s perceptions. This is why so many corporations spend a lot of money on advertising and on actions that will bring them positive publicity. This is also why some shareholders send out emails to strangers or post messages in Internet chat rooms to try to convince people to buy more stock.Stocks also go up or down depending on the mood of the country and the state of the economy. Once again, a lot is based on perception. If people believe that economic conditions are improving and the country is on the right track, they will be more inclined to invest in the stock market. There are some other reasons like: Politics, deflation, economic indicators, inflation, the dollar, and the Federal Reserve System: A Government You Can’t Ignore.

Stocks move for a variety of fundamental, technical, and economic factors, but the factors themselves are not as important as the perception of these factors. Basically, stocks are only worth what people believe they are worth. Every successful investment/trading strategy is built around finding a gap between present value and future value. You buy a stock when you think it will be worth more in the future and you sell/short when you expect it to be worth less in the future.

Why Earnings Winners Strategy?

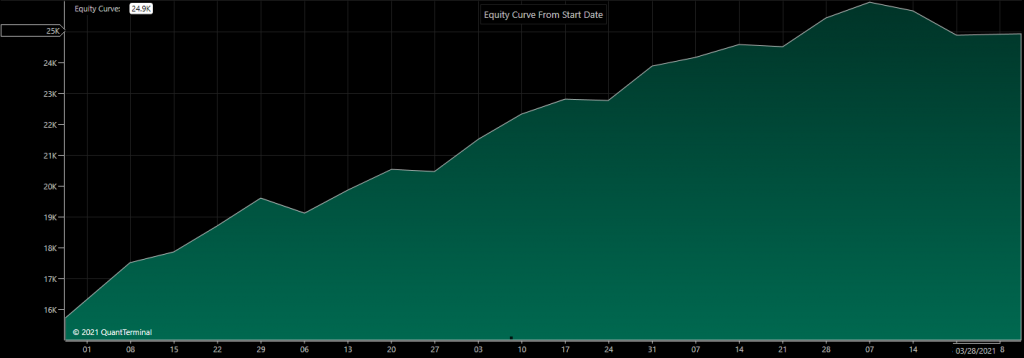

Earnings Winner is the idea of using stocks as a tool for accelerated account growth by buying the stock of companies just after they announce a favorable earnings report. These quarterly reports outline the financial stability of the company, offer forward-looking guidance on how the company is expected to perform in the future, and act as a catalyst to inject volatility into the stock, ultimately driving the price exponentially higher.

The Earnings Winner niche is ideal for novice traders because companies schedule their earnings dates ahead of time, making these reliable events extremely easy to track and build trading systems around. The trade signals are basic in principle, easy to learn, and often take multiple days to play out. This means you don’t need to be glued to your screen watching the stock market every minute of the day. Once you get the hang of it, it is very much a rinse and repeat style approach. It’s an ideal strategy for anyone who is busy with a full time job, school, or any other obligation.

Tell us more about EarningsWinner.io

EarningsWinner.io is an app that is dedicated to finding and tracking the best opportunities for our earnings strategies. It’s where I build my daily watchlists and scan the markets for new opportunities. Stock market research can be incredibly time-consuming, so we built an app to streamline the analysis process. Previously there was no app or website available to research and understand the trading opportunities surrounding an earnings announcement. Now anyone can build their own research tools by using the Earnings Winner app and make money by trading the stocks on our curated watchlists.

When and where can a person start trading?

As an aspiring trader, making sense of the markets can be tough. There’s so much information out there and you don’t know what is actually relevant to you. Start by conducting an honest self-assessment. What are your investment goals, and what styles of investment align with those goals? Before you start trading, you’ll want to have all of the proper tools. There are a lot of different brokers, software services, and charting platforms, but they are not all created equal. Find a mentor with years of experience in the markets that will help you get set up with the proper trading tools so you can save time and money by doing things right the first time. But this is just the beginning; trading is an ongoing learning process. Don’t be afraid to experiment with different markets and strategies. It will take some time to figure out what works best for your lifestyle and goals. Once you find the right system for you, make a plan and stick with it! It may be tempting to chase the latest hot stock but you will do yourself a huge favor by maintaining a disciplined approach to investing.

How can appropriate risk management be used?

The only thing easier than making money in the markets is losing money in the markets. Successful investing over the long term is all about making money and keeping it. If you are a long-term investor be sure to have a properly diversified portfolio. This means balancing offensive instruments, such as stocks, with defensive investments such as bonds. If you are a short-term trader, work to develop strategies around position sizing while keeping your losses small. We have been in a sustained bull market for so long that it is easy to forget that not all stocks go up. You don’t have to be right on every trade. Losses are a part of running any business, and trading is no different. How you manage the losses is what will determine your success over the long term.

How to deal with market fluctuations and price volatility indicators?

“It depends on your time horizon and investment goals”, Hasnae says. If you are a retirement investor, someone who has a time horizon of multiple decades, market fluctuations are meaningless. Do you expect your investment to go up over the next few decades? If so, what the market is doing today is irrelevant. Simply stay the course and honor your plan (you do have a plan don’t you?). As a short-term trader, it can be useful to build skills around both `buying and shorting. Shorting stocks can be seen as incredibly risky to the uninformed, but with proper risk management in place, making money when stocks go down can be quite an advantage. Another common practice for short-term traders is to simply sit in cash and wait for the fluctuations to smooth out and continue trending.

Related Posts

May 5, 2023

Beginner Stock Trading Tactics for Post-Earnings Momentum

Earnings season is an exciting time for stock traders, as it can lead to…

March 30, 2023

Buying Earnings Winners in Structural Bases: The Cup-with-Handle Approach

Successful stock trading often involves identifying patterns that signal…

March 23, 2023

Demystifying Earnings Events: A Beginner’s Guide for Entry-Level Traders

Earnings events are significant market occurrences that can greatly impact a…