If you’re looking to make money online, the stock market is a great place to get started. The barrier to entry is relatively low since you don’t need that much upfront capital, and it’s pretty easy to get things going. The markets offer immediate results, so it’s easy to determine if you’re on the right track, or if you need to rework your research methodology.

When I search for the best stocks to buy, I look for three easily identifiable catalysts: a positive reaction to earnings, a high percentage of the float sold short, and a technical breakout.

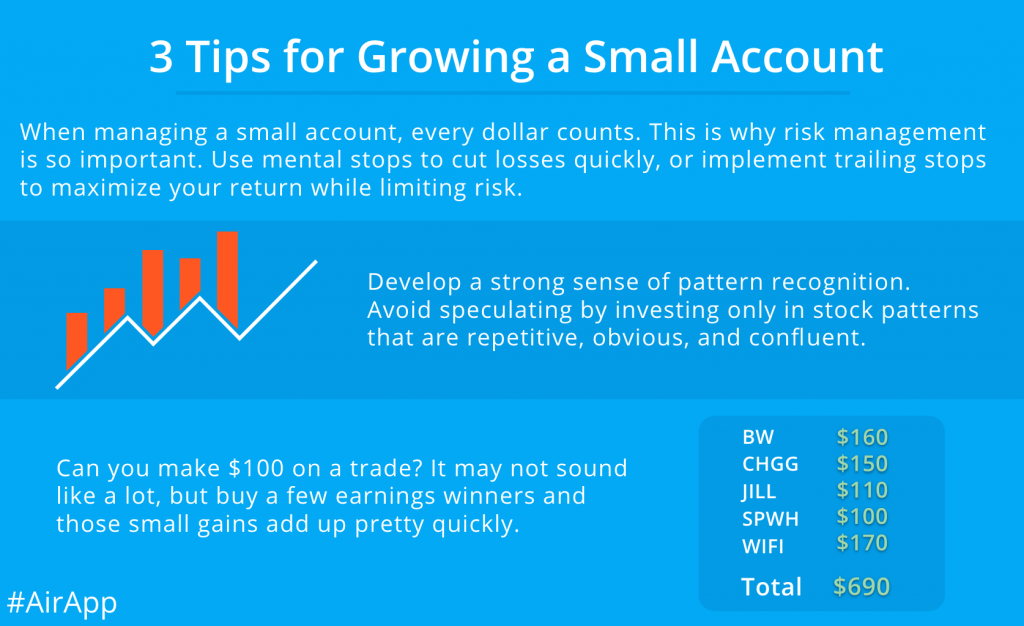

Earnings winners are great stocks to buy when growing a small account because they offer the volatility and low trading price needed to propel your capital growth efforts.

TIMfundamentals Part Deux teaches you how to find stocks to trade and build a watchlist, and I’ve largely stuck to that process over the last few years. I started going through the top percent gainers on Yahoo Finance several times a day, but quickly realized how difficult that is to do with other full time commitments.

I couldn’t keep checking Yahoo or any of the other research outlets throughout the day, so I developed a program to conduct my research for me. It builds a top percent gainers list based on stocks that are up on recent earnings related news, and that fit some other criteria I have found to be important for this niche. This “market movers” list provides the latest charts, headlines, and real-time data for each symbol, and the app also keeps tabs on my earnings calendar throughout the day, so I can be prepared ahead of time while remaining updated as the day moves along.

I’ve been trading based on this research delivery method for years, and this is the best and easiest way to find earnings winners. I only need to check in with the markets a few times a day, so I can spend the rest of the day living my life.

Update: My research algo has evolved into a screener app dedicated to earnings plays. Check it out here

Related Posts

May 5, 2023

Beginner Stock Trading Tactics for Post-Earnings Momentum

Earnings season is an exciting time for stock traders, as it can lead to…

March 30, 2023

Buying Earnings Winners in Structural Bases: The Cup-with-Handle Approach

Successful stock trading often involves identifying patterns that signal…

March 23, 2023

Demystifying Earnings Events: A Beginner’s Guide for Entry-Level Traders

Earnings events are significant market occurrences that can greatly impact a…