“Metaverse” and “Web 3” are the latest marketing buzz words to make the rounds. If you aren’t familiar, the metaverse is referring to virtual reality and the digital universe, while Web 3 is pretty much a rebrand of crypto.

These are not new concepts.

Cryptocurrency has been around since the 1980s, although it didn’t really begin to get mainstream attention until Bitcoin launched in 2008 (still close to 15 yrs ago).

Virtual reality has been around in one way or another since the 1800s, but true digital ecosystems didn’t come around until the early 2000s (still 20+ yrs ago), when games like Second Life and The Sims lured people into their digital ecosystems.

Both have been around for decades, but are experiencing a resurgence in popularity due to the recent crypto bull market cycle, advances in technology, and clever rebranding.

In this post, we’ll explore the different ways to invest in these themes via the stock market, if you happen to find yourself curious, or even bullish.

There are a handful of companies investing in the Metaverse (most notably Facebook, having renamed their company to Meta). In addition to Facebook, you’ll also find Amazon, Apple, Microsoft, and many more companies in the mix. With so many stocks to choose from, how could you possibly pick the one that will go to the moon?

The same goes for crypto. There are so many stocks dabbling in crypto technology (blockchain), it’d be extremely poor odds to try and pick any individual stock.

As smart investors, we know this is a fool’s errand, and it is a much better practice to limit risk, diversify, and stack the odds in our favor. Instead of trying to guess which stock will be the winner, it’s better to invest in the theme as a whole. Bullish on The Metaverse? Why not buy ALL the stocks participating in this space? It may sound like a lot of work (and expensive) to research and buy shares in each individual stock, but it’s actually quite simple. We can do this by investing in ETFs.

Metaverse ETFs: There is only one fund right now that offers exposure into this sector, and it’s Roundhill’s $META ETF. The fund is comprised of 44 stocks, all with different amounts of exposure. The top three holdings are $FB, $NVDA, and $RBLX, altogether accounting for nearly 25% of the entire fund. The fund’s expense ratio is quite high at .75%, compared to a total market fund like VTI’s .03% expense ratio. It is also still pretty new, having launched only 6 months ago. Looking at the chart, the fund tends to outperform the S&P 500 during rallies, while underperforming during periods of decline. This is definitely a high-risk, high reward type of investment, but if you’re bullish on The Metaverse, you could potentially make some decent coin by investing in this ETF.

Crypto ETFs: These funds tend to invest in Crypto’s underlying technology: blockchain. They own stocks in companies that have business operations in blockchain technology or profit from it in some way. While blockchain is relatively new, many of the companies that operate in the space are well established (think IBM, Oracle, and Visa). The three ETFs we’ll mention here ($BLOK, $BLCN, $LEGR) are ranked by on-year trailing total return. While there is no benchmark index for the blockchain industry, the broader tech sector is a reasonable reference point. The S&P 500 Information Technology Sector Index ($XLK) has outperformed the broader market in the past year, providing 1-year trailing total returns of 31% compared with 25% for the S&P 500 ($SPY) as of Dec. 20, 2021. $BLOK (up 39% year-over-year), is best-performing blockchain ETF based on performance over the past year, followed by $LEGR (+15%), and finally $BLCN (+6%).

Related Posts

May 5, 2023

Beginner Stock Trading Tactics for Post-Earnings Momentum

Earnings season is an exciting time for stock traders, as it can lead to…

March 30, 2023

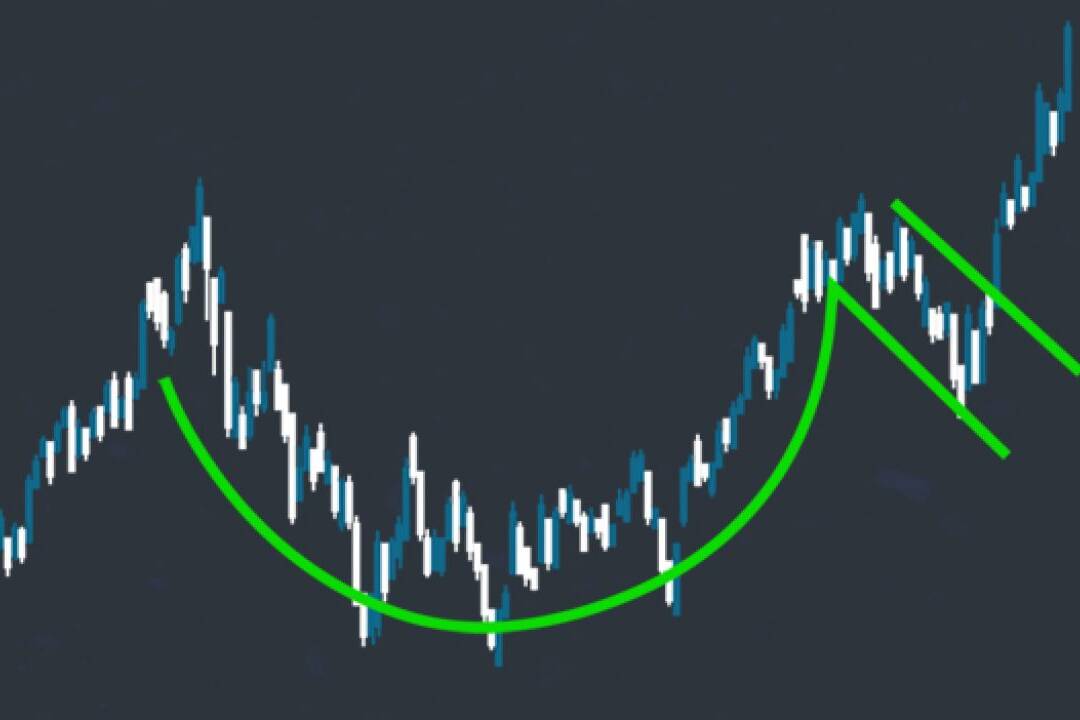

Buying Earnings Winners in Structural Bases: The Cup-with-Handle Approach

Successful stock trading often involves identifying patterns that signal…

March 23, 2023

Demystifying Earnings Events: A Beginner’s Guide for Entry-Level Traders

Earnings events are significant market occurrences that can greatly impact a…