While multiple ETFs offer exposure to NASDAQ indexes, the QQQ ETF is the leader of that group. QQQ tracks the widely followed Nasdaq-100 Index, which is a benchmark that holds some of the most popular tech stocks. At the time of this writing, tech stocks make up more than 60% of this fund’s assets.

Unlike many other ETFs, QQQ is much more concentrated in its top holdings — investing more than 30% of its assets in Microsoft, Apple, and Amazon — and is more volatile than most other large-cap funds. Because of this, the ETF is often viewed as a snapshot of how the technology sector is performing as a whole.

| QQQ Annual Performance | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| 19.89% | 3.44% | 18.09% | 36.60% | 19.12% | 9.54% | 7.01% | 32.70% | -0.14% | 39.12% |

Per the rules of its index, the fund only invests in non-financial stocks that are listed on the NASDAQ exchange, and effectively ignores other sectors as well. The Nasdaq 100 Index is made up of 100 of the largest companies across the globe (excluding financial companies) that are listed on the NASDAQ stock exchange.

| ETF | Expense Ratio | 10yr Performance |

| QQQ | 0.20% | 17.29% |

| QQQE | 0.35% | 10.48% |

| QQEW | 0.59% | 14.10% |

| ONEQ | 0.21% | 15.47 |

Related Posts

May 5, 2023

Beginner Stock Trading Tactics for Post-Earnings Momentum

Earnings season is an exciting time for stock traders, as it can lead to…

March 30, 2023

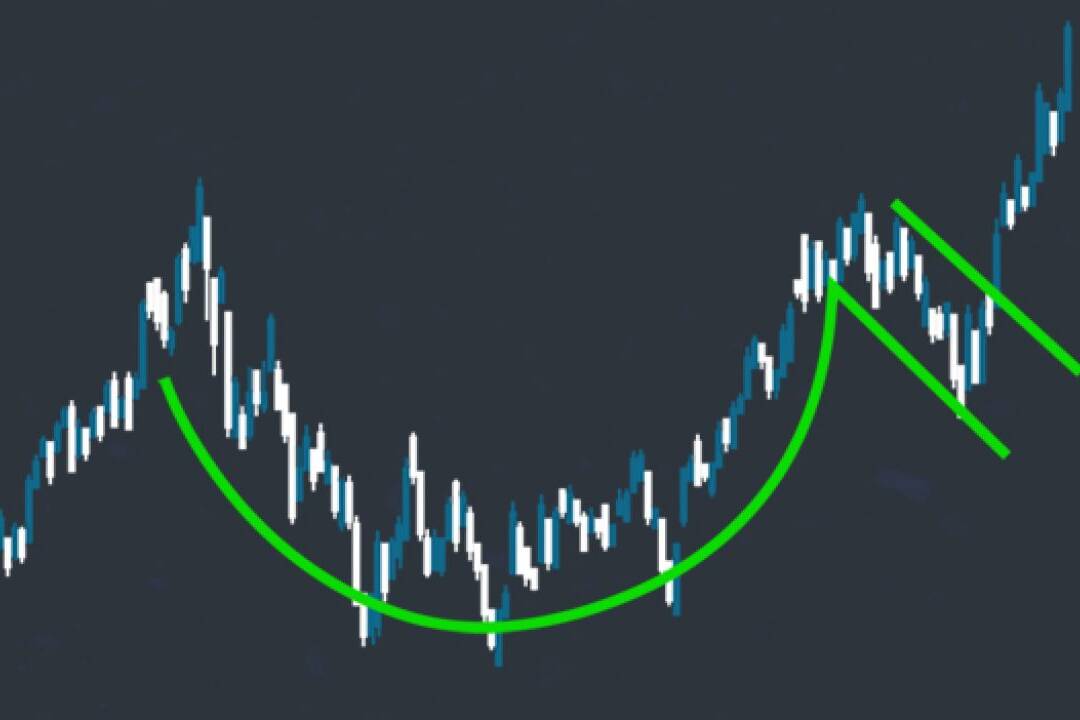

Buying Earnings Winners in Structural Bases: The Cup-with-Handle Approach

Successful stock trading often involves identifying patterns that signal…

March 23, 2023

Demystifying Earnings Events: A Beginner’s Guide for Entry-Level Traders

Earnings events are significant market occurrences that can greatly impact a…