1️⃣ MASTER A FEW STOCKS

2️⃣ RESPECT RISK MANAGEMENT

3️⃣ TAKE PROFIT DON’T GET GREEDY

4️⃣ TRADE YOUR PLAN

5️⃣ CONTROL YOUR EMOTIONS

6️⃣ TRADE LESS

7️⃣ NEVER COMPARE

1️⃣ MASTER A FEW STOCKS

Select 3-4 stocks and trade them daily. You need to learn them like the back of your hand. Study the stocks price action daily using candlesticks, support and resistance, volume, and very few indicators. (SMA, EMA & VWAP)

Use simple high probability setups to trade.

Here is 1 very simple one. VWAP bounces or rejections.

VWAP trading tip: If a stock is breaking out on the daily chart watch for the pullback into VWAP on the 1 min chart and go long.

2️⃣ RESPECT RISK MANAGEMENT

5-10% max loss on longterm trades

If you have a $5K account risk is $250 to $500 per trade.

2-5% max loss on swing trade

1% max loss on day trades

3️⃣ TAKE PROFIT DON’T GET GREEDY

2 WAYS

1. You can take profit when you hit a certain percentage gain. The downside is this could turn you into an emotional trader.

2. A better way to take profits is to exit when the price is coming into a major technical area on the chart

SO IF YOU’RE LONG AND IN A WINNING TRADE YOU WOULD EXIT AT MAJOR RESISTANCE ON THE DAILY CHART.

4️⃣ TRADE YOUR PLAN

This is very important. Have a plan before you enter your trade.

You want to identify your setup then what your entry will be, your stop loss, and then your profit target.

Be reasonable with the profit target.

The trade plan is there for you when things become emotional for you.

You made the plan with no emotion so lean on it when you become emotional.

5️⃣ CONTROL YOUR EMOTIONS

Controlling your emotions is also important.

You have the trade plan to help you through this.

You will always have emotions during the trade so learn from them.

Trading like a robot is nice to say but it’s pointless to focus on.

Don’t get caught in FOMO. If you miss a trade wait for the next one. The trade you missed isn’t the last trade ever.

Always be DISCIPLINED.

6️⃣ TRADE LESS

Trading more doesn’t mean you will have more success. Make daily goals and once they are hit move on to the next day.

For example, take 1-3 trades, and if you lose the first one because you lacked patience stop trading.

If you win the first one take another one but keep in mind a previous win means nothing to a future trade.

Trade less and only take the best setups.

Don’t let your mind trick you into thinking every setup is the best. Track the setups that work best and use those setups only.

7️⃣ NEVER COMPARE

Never compare yourself with another trader. You are on your own journey.

I know social media is important to learn to trade but don’t get caught up in other traders’ wins. This can create a left behind mentality.

You can start risking more because you feel like since he or she made this amount I should be making that amount too

Also seeing a big trading win doesn’t mean they traded correctly.

They could have risked a lot several times and never shown you the previous big losses they took.

Related Posts

May 5, 2023

Beginner Stock Trading Tactics for Post-Earnings Momentum

Earnings season is an exciting time for stock traders, as it can lead to…

March 30, 2023

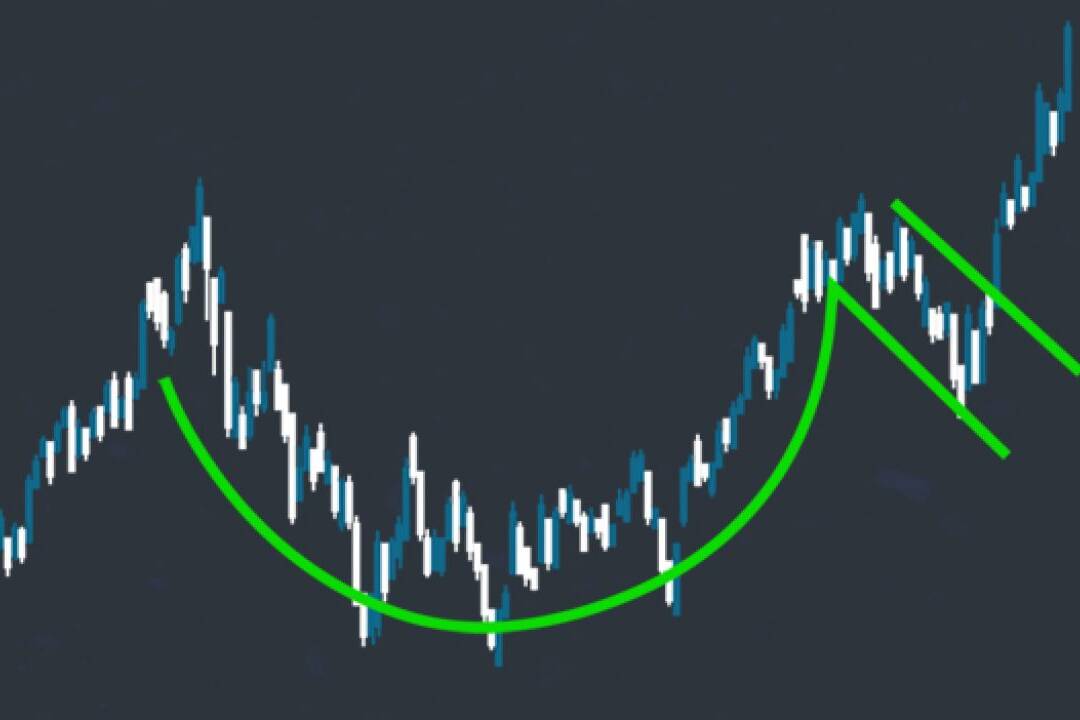

Buying Earnings Winners in Structural Bases: The Cup-with-Handle Approach

Successful stock trading often involves identifying patterns that signal…

March 23, 2023

Demystifying Earnings Events: A Beginner’s Guide for Entry-Level Traders

Earnings events are significant market occurrences that can greatly impact a…